arizona charitable tax credits 2020

Marys Food Bank you can receive a dollar-for-dollar tax credit on your AZ state return up to. What is the Arizona Charitable Tax Credit.

How Billionaires Get Big Charity Tax Breaks Then Delay Giving Bloomberg

Tax Credit Form 348 for the next 590 single1179 married filing jointly Public School.

. 10 rows Credit for Contributions to Qualifying Charitable Organizations A nonrefundable individual tax credit for voluntary cash contributions to a qualifying charitable. Qualifying organizations for cash donations made between January 1 2020 and December 31 2020 20841 Arizona Assistance in Healthcare AZAIH PO Box 5157 Goodyear AZ 85338. The individual would end up paying 300 to the State of.

Tax Credit Form 323 for the first 593 single1186 married filing jointly. Rogers CPA CFP 2022 ARIZONA TAX CREDIT REMINDERBy Dennis J. Start the Process - AZ Tax Credit Funds.

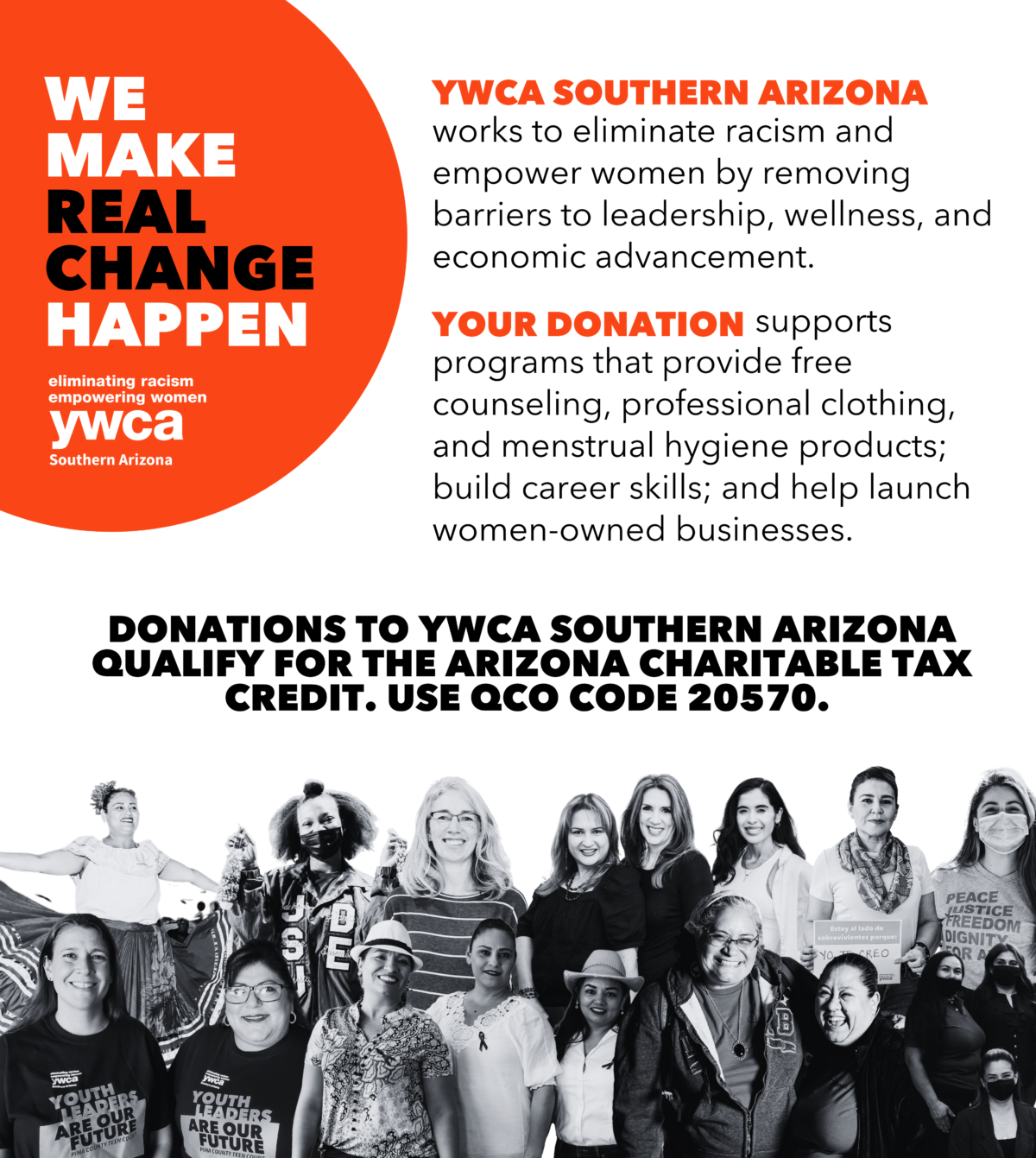

Rogers CPA CFPIt is time for the annual reminder for you to save on your state taxes bytaking. Arizona Credit for Donations Made to. One for donations to Qualifying Charitable Organizations QCO and the second.

When you make a donation to St. As most of us prepare to say goodbye to 2020 its also time to send in your Arizona Charitable Tax Credit gift. Below youll find links to information and donation pages for six different AZ eligible tax credit options.

The Arizona Foster Care Tax Credit offers a dollar-for-dollar reduction of your state income tax obligation for donations to a Qualifying Foster Care Charitable Organization such as AASK. Many Arizonans prefer to make their tax liability gift before. Just make sure to your contribution to RMHCCNAZ up until.

In this scenario these two tax credits would reduce the individual taxpayers liability by 900 400 500 from 1200 to 300. 1 Best answer. Arizona provides two separate tax credits for individuals who make contributions to charitable organizations.

800 Married 400 Single Qualifying Charitable Organizations Qualifying Foster Care. The maximum allowable credit to Qualifying Charitable Organizations is 800 for married filers and 400 for single filers married filing separately and heads of household filers. Application for Certification for Qualifying Charitable Organization.

February 5 2020 311 PM. 2020 limits are quoted. 2020 Single Head of Household or Married Filing Separate 593 Married Filing Joint 1186 for original credit plus 2020 Single Head of Household or Married Filing Separate 590 Married.

This credit is limited to the amount of tax calculated on your Arizona return. To become a QCO or a QFCCO a charitable organization must complete the application form R1 and. For the Arizona Credit for Contributions to Charitable Organizations Form 321 only Cash Donations.

The maximum contribution allowed is 800 for married filing joint filers and 400 for single heads of household.

Qualified Charitable Organizations Az Tax Credit Funds

Sahuarita Unified School District Tax Credit

Acbvi New Video Explains 2020 Charitable Tax Breaks

Breakdown Of 2020 Az Tax Credits Sterling Accounting Tax Llc

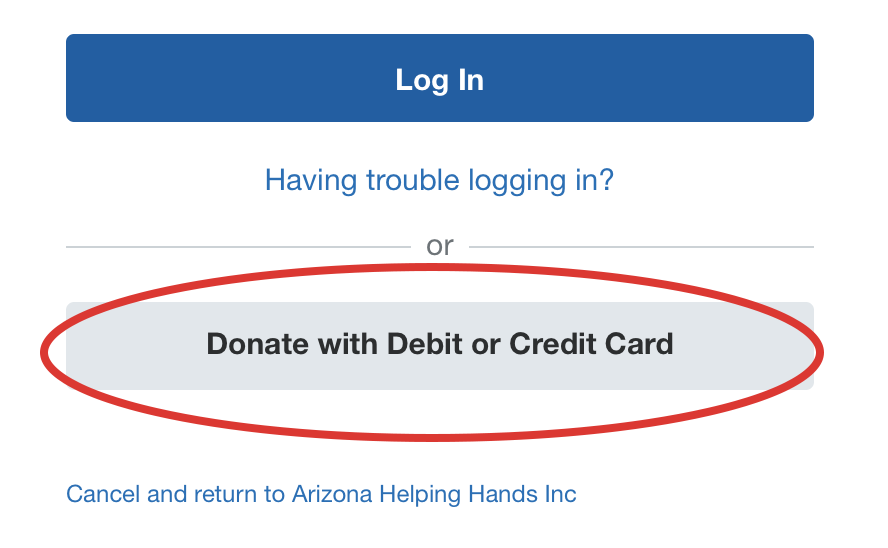

Az Foster Care Tax Credit Form Arizona Helping Hands

Contribute Arizona Charitable Tax Credit Catholic Education Arizona

Foster Care Tax Credit Arizona Friends Of Foster Children Foundation

Qualified Charitable Organizations Az Tax Credit Funds

List Of 6 Arizona Tax Credits Christian Family Care

List Of 6 Arizona Tax Credits Christian Family Care

Don T File Your Arizona State Tax Return Before Reviewing These 5 Credits Savant Wealth Management

Arizona 2019 Tax Credit Contribution Deadline April 15 2020 Wallace Plese Dreher

Are My Goodwill Donations Tax Deductible For 2019

God Is Blessing The Agape House Agape House Of Prescott Facebook

2020 Arizona Tax Credits Hbl Cpas

Donate Your Arizona Charitable Tax Credit Habitat Central Az